Transparent staking yields for your platform

Enable up to 26% Annual Percentage Yield (APY) on USDC and EURC from a curated selection of DeFi Liquidity Pools.

Enable up to 26% Annual Percentage Yield (APY) on USDC and EURC from a curated selection of DeFi Liquidity Pools.

Unlock DeFi earning opportunities across the most trusted blockchains.

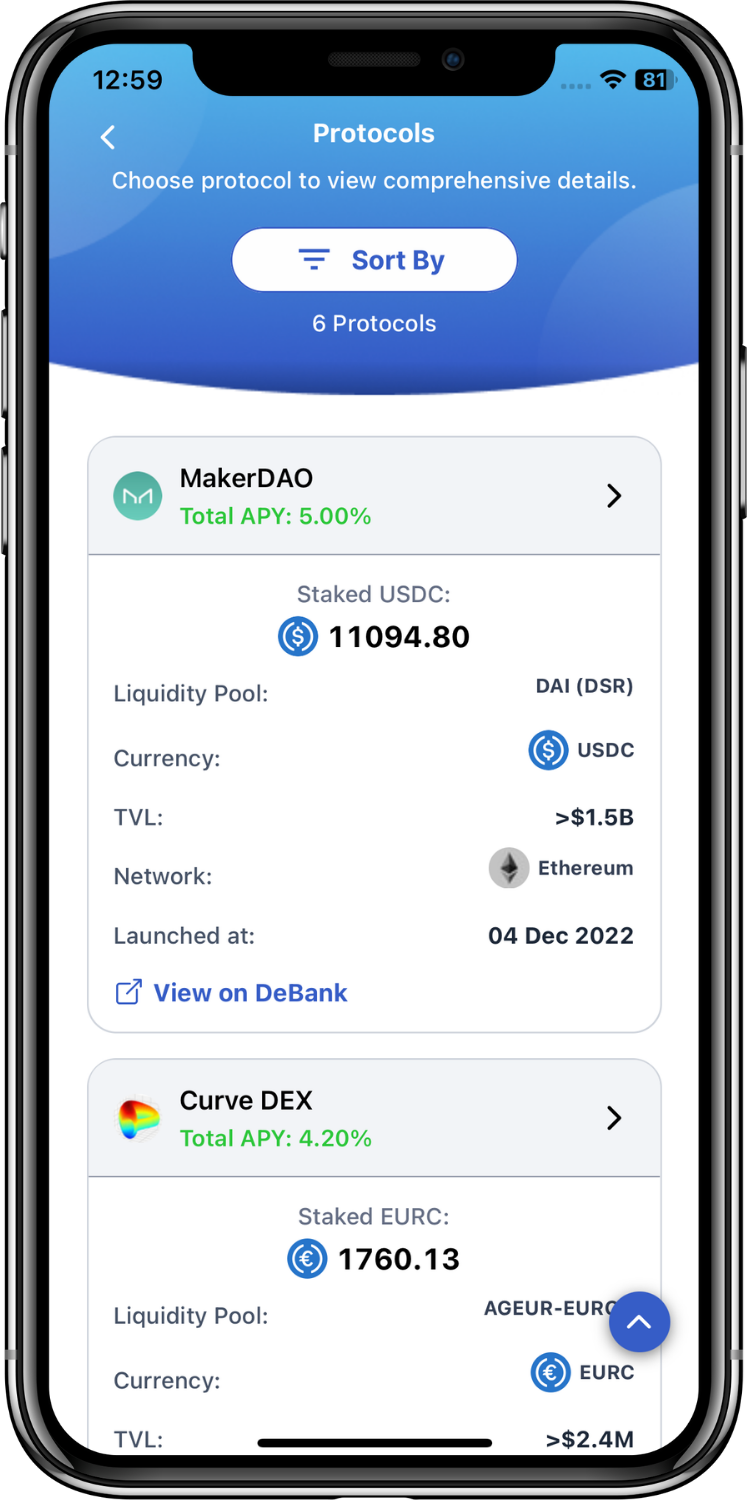

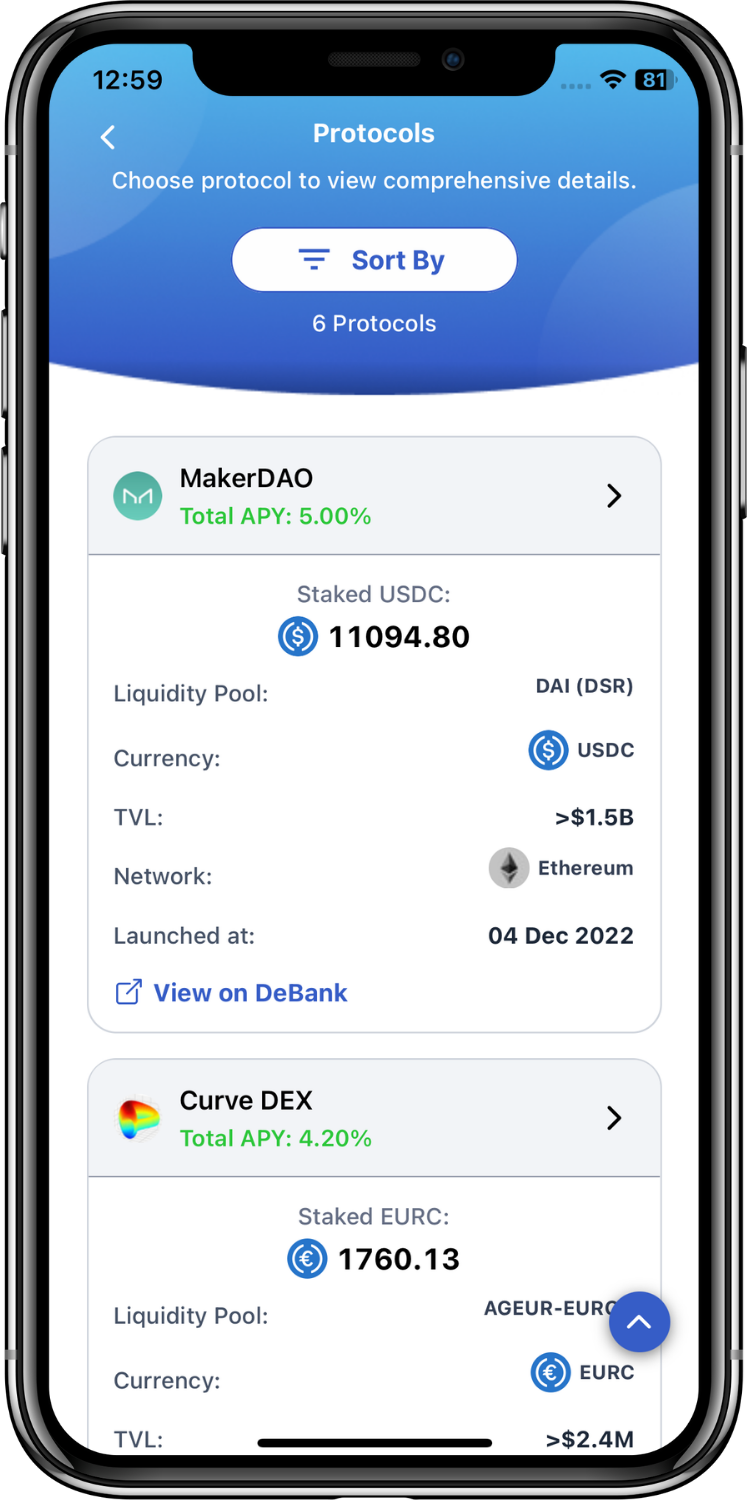

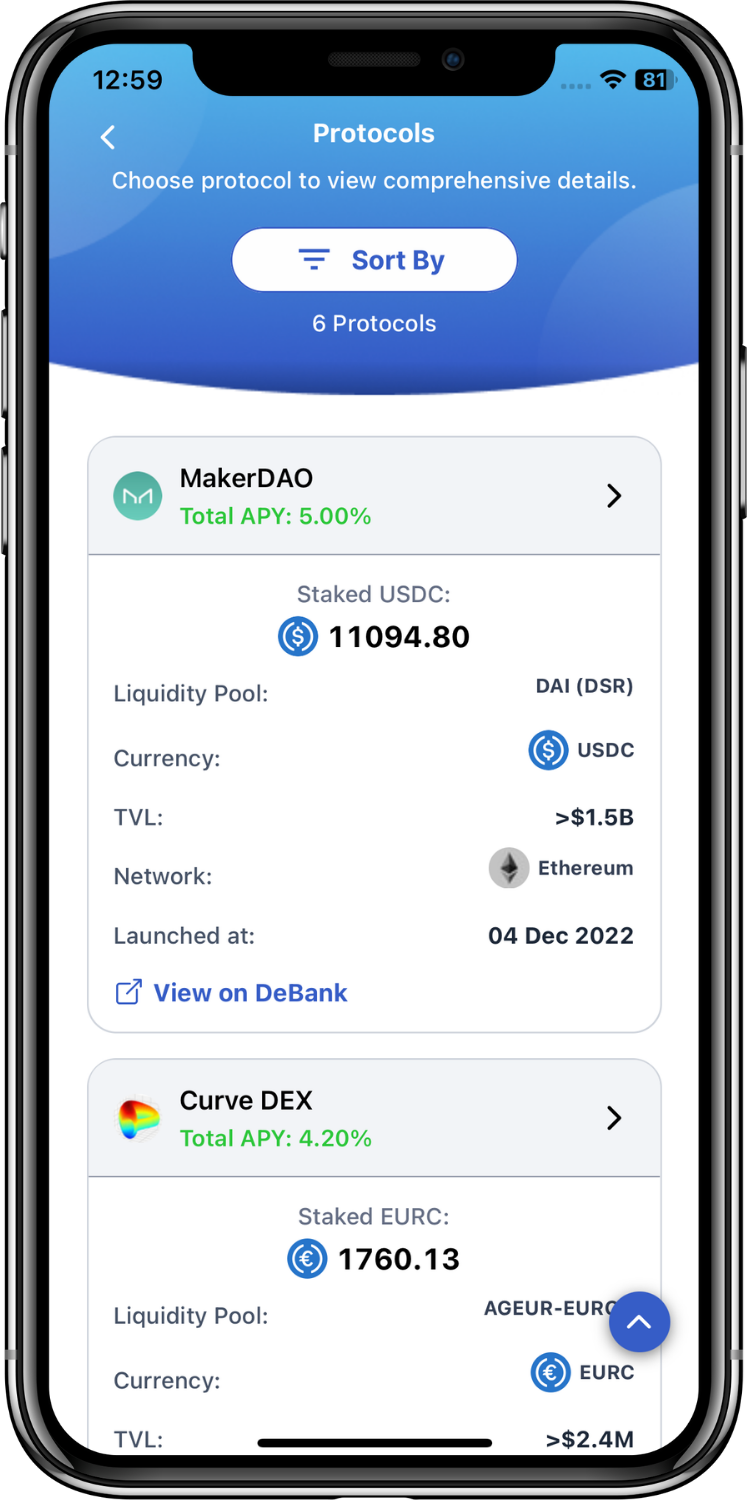

Empower your users to craft their own staking portfolio by selecting protocols and setting their investment sizes.

Offer seamless access to diverse liquidity pools across networks via a unified interface.

Ensure transparency with clear audit trails, transaction IDs, and smart contract addresses for all investments.

Streamline the process of becoming a Liquidity Provider (LP) to a few simple clicks, making DeFi accessible to users of all experience levels.

Optimize ROI by facilitateing staking and unstaking without network fees.

Access comprehensive historical and real-time usage reports, manage user access, and more through an intuitive interface.

Return Finance's REST API brings next-level Web3 capabilities to your platform.

Leveraging state-of-the-art technology to ensure a smooth and secure staking experience.

Validated by weiChain, a trusted name in the industry.

Regulated within the EU & Switzerland, committed to operational excellence and good governance.